irs tax act stimulus checks

COVID-19 Stimulus Checks for Individuals. Millions of Americans received stimulus checks in 2021.

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

That is the reason that such income cannot.

. In 2021 millions of Americans received a stimulus check worth up to 1400. Up to 10 cash back To prepare for the possibility of a third stimulus payment the IRS urges filers to consider filing their 2020 tax returns as soon as possible. 1 day agoHow to claim tax credits.

The Internal Revenue Service IRS plans to distribute fourth stimulus checks as part of the American Rescue Plan Act by the government. 22 hours agoOct 14 2022 0253PM EDT. The IRS stated customers should begin to see payments starting Feb.

On Thursday the IRS said it will send letters to more than 9 million families who are potentially eligible for benefits including stimulus payments or Child Tax Credits but didnt. 21 hours agoWASHINGTON There may be as many as 10 million people and families owed unclaimed stimulus checks and advance child tax credit payments according to a government. The latest round of stimulus checks will allow people to use.

In addition to the pandemic relief stimulus payments and the 2021 child tax credit you may have heard about so called 2022 stimulus checks. 22 hours agoThe Internal Revenue Service is mailing letters to households that could potentially get money from boosted child tax credit payments and the third stimulus check if. The American Rescue Plan Act ARPA of 2021 expands the CTC for tax year 2021 only.

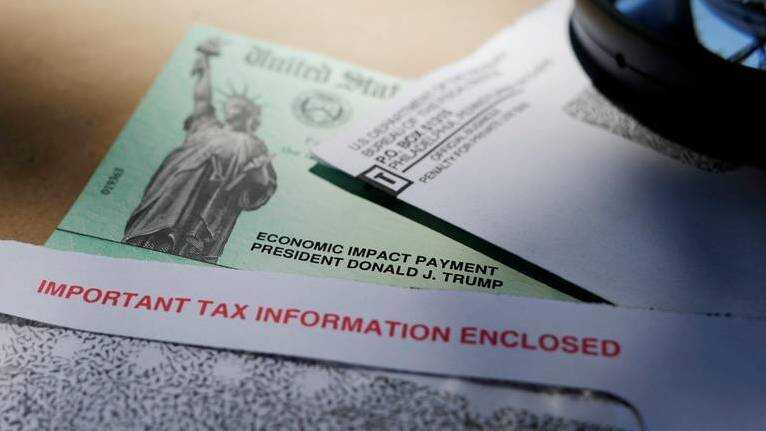

The Fourth Stimulus Package Update. The IRS says it is no longer deploying 1400 stimulus checks and plus-up payments that were due to qualifying Americans in 2021. The IRS will use the information on the Form-SSA and Form RRB-1099 to generate Economic Impact Payments of 1200 to these individuals even if they did not file tax returns in 2018 or.

This plan is established partly due to the. 1 day agoMore than 9 million people and families who did not receive their advance child tax credit checks stimulus payments and other tax rebates will soon get a letter from the IRS to. However there may still be people.

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. TaxActs free Stimulus Registration service has been designed to help millions of Americans submit their information to the IRS in order to receive their stimulus payment also. We are deeply disappointed.

The main reason behind this logic is that none of such payments are part of the adjusted gross income of an individual or a couple. Some people who did not. Most Americans received 1400 stimulus checks in 2021 but many more could still be eligible.

A number of the billionaires who received stimulus checks were able to report negative incomes to the IRS despite getting richer. The IRS is contacting millions of people who may still be eligible for 1400. A billionaire income tax proposed by.

For the second stimulus check it came from 2019 tax filings. Well I got this email today from TaxAct looks like well see our stimulus starting February. For the first stimulus check that came from 2018 or 2019 tax filings.

1200 in April 2020. The IRS is contacting millions of people who may still be eligible for 1400 stimulus checks and special tax credits worth thousands more. 2021 Third Stimulus Check Income Qualification and Phase-out Thresholds Limits Expanding Dependent Eligibility.

The 2022 stimulus checks are. That was the third round of stimulus. The IRS is contacting millions of people who may still be eligible for 1400 stimulus checks and special tax credits worth thousands more.

The 2021 Child Tax Credit is up to 3600 for each qualifying child. If you qualify for the tax benefits that were part of the American Rescue Plan Act of 2021 and have yet to claim them youll need to file a 2021 tax. The IRS is pulling that information from.

Eligible families including families in. Stimulus Package Update Fourth Stimulus Check Update Today 2022 Gas Stimulus Checks Daily News Update and IRS Tax Refund 2022 Update.

What Was Your Stimulus Payout You Ll Need To Know To File Those Taxes

Irs Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

What Non Tax Filers Need To Know About Economic Impact Payments Consumer Financial Protection Bureau

Which Irs Stimulus Check Tool Should You Use

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

How Much Were The First Second And Third Stimulus Checks And When Were They Sent Out As Usa

Third Stimulus Check Is Not Taxable Verifythis Com

Stimulus Check 2021 What To Do If You Must File A Tax Return

Plus Up Stimulus Checks Have Already Been Sent To 9 Million Americans Will You Get One Too Kiplinger

Get My Payment Internal Revenue Service

My Son Got A 1 200 Stimulus Payment He Wasn T Entitled To Is There Any Way To Take Back My 2019 Irs Return Answers To Your Stimulus Check Questions Part 1 Marketwatch

The Third Stimulus Check How Much And Who Gets It Taxact

Don T Throw Away These Letters From The Irs Taxact Blog

How To Find Out When You Re Getting Your Stimulus Check Pcmag

Irs Admits Mistake In Noncitizens Receiving 1 200 Coronavirus Stimulus Checks Npr

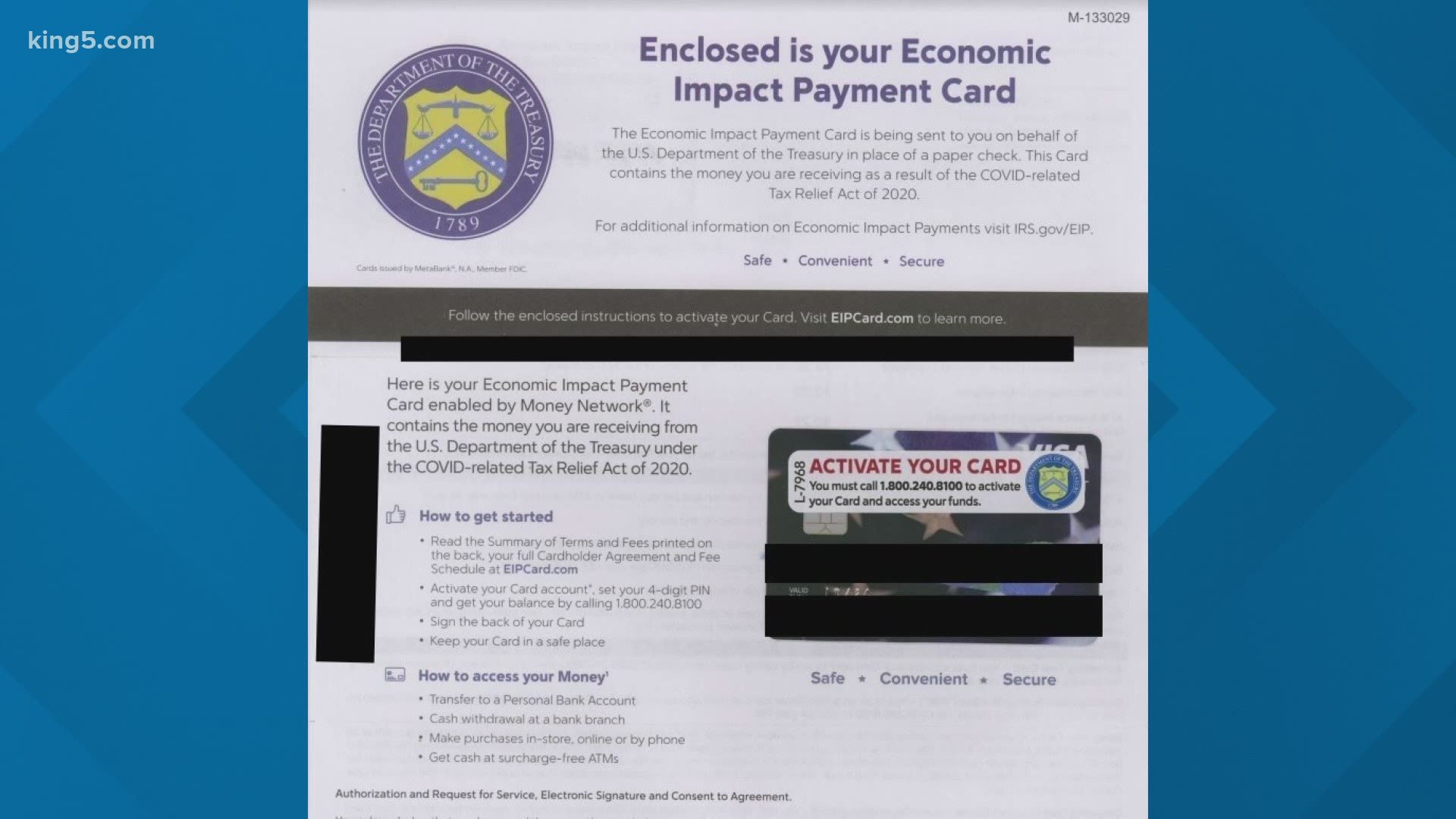

Economic Impact Payment Card Don T Throw Out Your Stimulus Money King5 Com

Child Tax Credit And 3rd Stimulus Watch For These Irs Letters 11alive Com

How To Set Up An Irs Payment Plan Through Taxact Taxact

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post